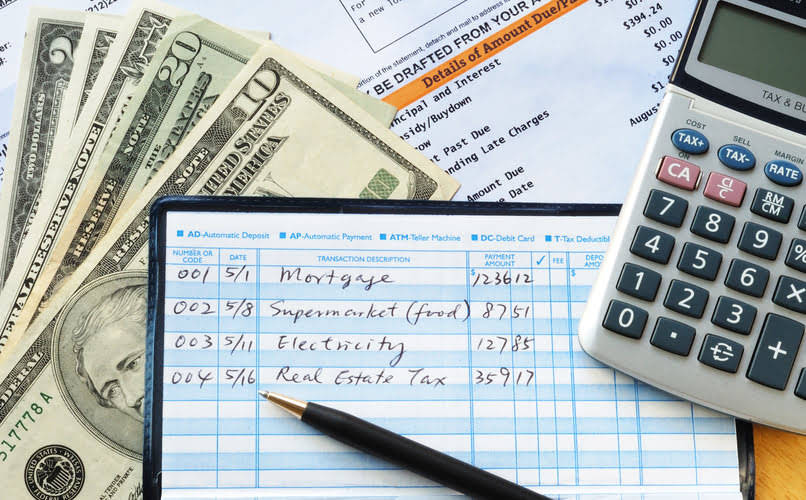

Businesses and even personal transactions are sometimes done using checks. Checks have been in use for a long time and are considered to be a convenient mode of transaction by most businessmen. The only additional task related to them is the employer must send his employee to cash it within a specific time. If he fails to remind his HR employee or any other professional who is in charge of taking the checks to the bank, they become stale-dated checks.

Chase for Business

Having a bookkeeper or accountant in the organization can be a great help to the employer. As a result of the difference in the state rules, the time required for a check to become stale also varies for the various states in the U.S. Hence, as per the available information, the check can be considered stale if not cashed in the bank within 60 days or it might never be considered stale. Some cashier’s checks have no specific expiration date and should theoretically be valid for as long as the issuing bank is operating. At the same time, some may become stale after 60 to 180 days. If you try to cash an expired or stale check, there’s a possibility that both your bank and the bank that issued the check may still honor it.

- But this compensation does not influence the information we publish, or the reviews that you see on this site.

- Again, only if the bank committed some type of outrageous wrong could a claim for punitive damages succeed.

- Stop payments are an essential factor as they highlight why bookkeeping is necessary for the success of your business.

- However, many businesses tend to put a length of time on the check for accounting purposes.

About Chase

This step helps avoid problems and reduces risks such as bounced checks. While checks may not have a fixed expiration date, they can become stale after a certain amount of time. You may not be able to cash or deposit a stale-dated check. If you find an old paycheck that has expired, your employer may be able to issue a replacement. However, after a certain amount of time, the employer may have to turn the money over to the state as unclaimed funds.

banking basicsWhat is a bank account number?

Checks that remain outstanding for long periods of time can’t be cashed, as they become void. Outstanding checks that remain so for a long period of time are known as «stale» checks. Some checks become stale if dated after 60 or 90 days, while all become void after six months. Do personal checks expire more quickly than company-printed checks? When someone gives advance written notice to your bank to not cash a post-dated check, the request is valid for six months under state law. Banks are obligated to follow these requests from their clients strictly.

The Check Is Made to a Business Name

However, a money order can lose value after a certain amount of time passes. So, similar to checks, it’s wise to cash or deposit a money order right away. Cashier’s checks can be a little confusing with regards to expiration dates, which can vary based on local laws.

Personal checks, payroll checks, and business checks have the shortest shelf life. Imagine a check as a perishable item with a shelf life of six months. After that period, it becomes stale and useless for payment. If you miss this window, the bank won’t accept it, and you won’t get the money in your account.

What happens if you deposit an expired check?

The time period varies by state, but the unclaimed funds’ surrender usually happens within 3 to 5 years. The money for the cashier’s check is set aside in an internal bank account. If unclaimed for a certain amount of time, the bank must checks are stale dated when turn the money over to the state as “unclaimed.” This time frame also varies by state. Business checks are good for 180 days after the date printed on the check. However, banks may honor a business check that is older than 6 months.

- Having a bookkeeper or accountant in the organization can be a great help to the employer.

- However, a money order can lose value after a certain amount of time passes.

- U.S. Treasury checks expire one year from the date they were issued.

- But the obligation to pay still exists, so it’s best to deal with payments as soon as possible.

- At this point, the only way to process the payment is if the drawer — otherwise known as the check writer or issuer — changes the date on a replacement check or issues a new check.

- However, it’s also possible that your bank might reject the check, and you’ll have to ask for a replacement.

The validity period for a check often depends on whether it’s a personal check, business check or cashier’s check. A bank will, in good faith, do all it can to stop payment on a check, but a bank will not guarantee that the check will not be processed. Generally speaking, banks or other financial institutions have the right to refuse or reject a stale check. Checks can become stale or outdated after a certain amount of time has passed.