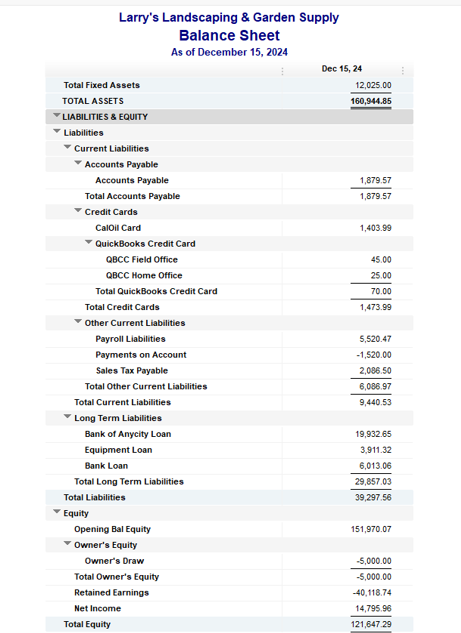

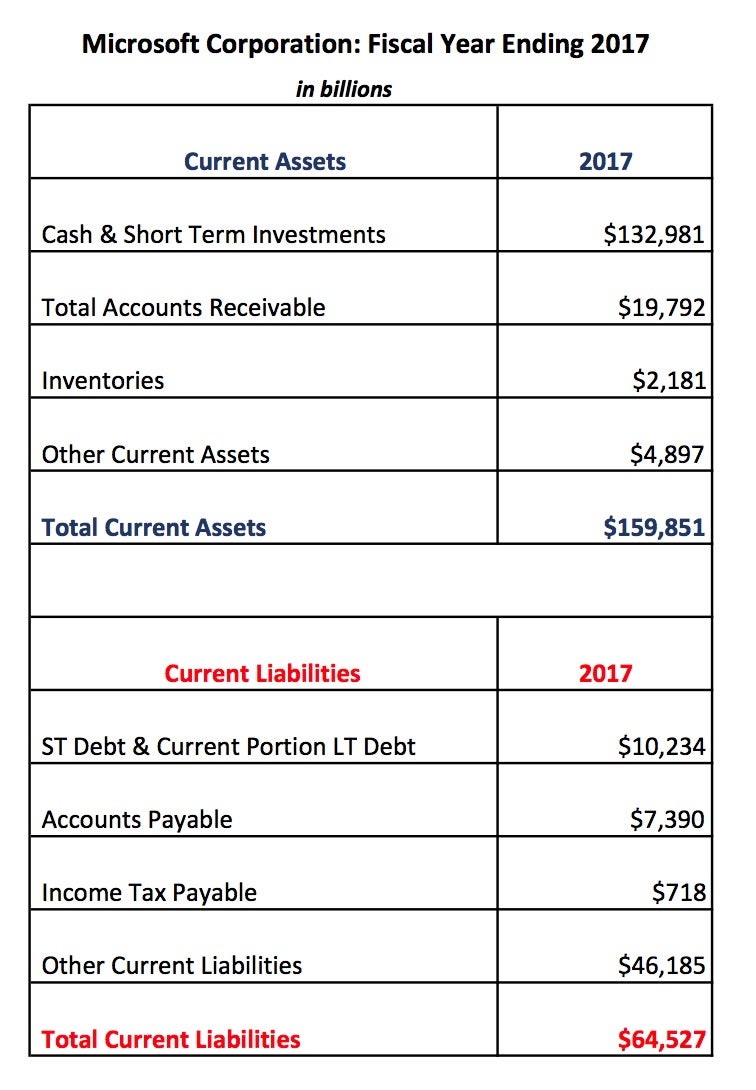

In other words, the current ratio is a good indicator of your company’s ability to cover all of your pressing debt obligations with the cash and short-term assets you have on hand. It’s one of the ways to measure the solvency and overall financial health of your company. GAAP requires that companies separate current and long-term assets and liabilities on the balance sheet. This split allows investors and creditors to calculate important ratios like the current ratio.

Current Ratio vs. Other Liquidity Ratios

Although both measure liquidity, the difference lies in the types of assets they consider. The current ratio includes all current assets, including inventory and prepaid expenses, which are not part of the acid test ratio. It is important to note that a similar ratio, the quick ratio, also compares a company’s liquid assets to current liabilities.

Editorial integrity

The more liquid a company’s balance sheet is, the greater its Working Capital (and therefore its ability to maneuver in times of crisis). The current ratio helps investors and creditors understand the liquidity of a company and how easily that company will be able to pay off its current liabilities. This ratio expresses a firm’s current debt in terms of current assets. So a current ratio of 4 would mean that the company has 4 times more current assets than current liabilities. Current assets include only those assets that take the form of cash or cash equivalents, such as stocks or other marketable securities that can be liquidated quickly.

What Is Equity, and How Do You Calculate It?

- Short-term solvency refers to the ability of a business to pay its short-term obligations when they become due.

- A financial professional will be in touch to help you shortly.

- Here, the company could withstand a liquidity shortfall if providers of debt financing see the core operations are intact and still capable of generating consistent cash flows at high margins.

- As the amount expires, the current asset is reduced and the amount of the reduction is reported as an expense on the income statement.

- Most corporations tend to keep a record of their current ratios on either a monthly or quarterly basis.

Everything is relative in the financial world, and there are no absolute norms. The current ratio is a rough indicator of the degree of safety with which short-term credit may be extended to the business. The current ratio is calculated using the formula shown below. On the other hand, the current liabilities are those that must be paid within the current year. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Ultimately, there is no one ratio to determine a company’s health. It’s ideal to use several metrics, such as the quick and current ratios, profit margins, and historical trends, to get a clear picture of a company’s status. The current ratio can be useful for judging companies with massive inventory back stock because that will boost their scores. On the other hand, the quick ratio will show much lower results for companies that rely heavily on inventory since that isn’t included in the calculation. To calculate your current ratio, simply take your current asset value and divide it by the value of your current liabilities. Our current ratio calculator will allow you to calculate not only the current ratio but also the historical financial ratios as well as the year on year ratio changes.

Now that businesses know how to calculate the ratio, how do they make sense of it? Our blog articles are written independently by our editorial team. Andy Smith is a Certified Financial Planner (CFP®), licensed realtor and educator oecd income tax wedge chart with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career.

The Current Ratio is not a static figure but can fluctuate. Various factors, such as changes in a company’s operations or economic conditions, can influence it. Monitoring a company’s Current Ratio over time helps in assessing its financial trajectory.

A high ratio implies that the company has a thick liquidity cushion. The interpretation of the value of the current ratio (working capital ratio) is quite simple. As it is significantly lower than the desirable level of 1.0 (see the paragraph What is a good current ratio?), it is unlikely that Mama’s Burger will get the loan. Be sure also to visit the Sortino ratio calculator that indicates the return of an investment considering its risk.