Let’s now apply these behaviors to the concept of contribution margin. The company will use this “margin” to cover fixed expenses and hopefully to provide a profit. The key component of the contribution per unit calculation that can cause difficulty is the variable cost. This should only include those costs that vary directly with revenues. Thus, it should not include any overhead cost, and should rarely include direct labor costs. Direct labor costs are actually a fixed cost when a production line is used, since it requires a certain fixed amount of staffing to operate the line, irrespective of the number of units produced.

Fixed cost vs. variable cost

It means there’s more money for covering fixed costs and contributing to profit. Yes, the Contribution Margin Ratio is a useful measure of profitability as it indicates how much each sale contributes to covering fixed costs and producing profits. A high Contribution Margin Ratio indicates that each sale produces more profit than it did before and that the business will have an easier time making up fixed costs. A low Contribution Margin Ratio, on the other hand, suggests that there may be difficulty in covering fixed costs and making profits due to lower margins on individual sales. The contribution margin represents the revenue that a company gains by selling each additional unit of a product or good. This is one of several metrics that companies and investors use to make data-driven decisions about their business.

Contribution Margin: What it is and How to Calculate it

Profits will equal the number of units sold in excess of 3,000 units multiplied by the unit contribution margin. As a final tip, look for ways to reduce costs by sourcing cost-effective materials that won’t compromise your product’s how to find contribution per unit quality. Focusing on high-margin products, upselling, and cross-selling can help in improving the overall contribution margin. The contribution margin offers visibility into the profitability of individual products.

How to Calculate Contribution per Unit

Before proceeding with a detailed guide on finding unit contribution margin, the first step is to know your fixed and variable costs. You will use these often, particularly variable costs, to calculate unit contribution margin. Contribution margin may also be expressed as a ratio, showing the percentage of sales that is available to pay fixed costs. Contribution margins represent the difference between the selling price and the cost of goods sold and are crucial for enhancing overall profitability. By optimising your pricing strategies, you can significantly improve your contribution margin.

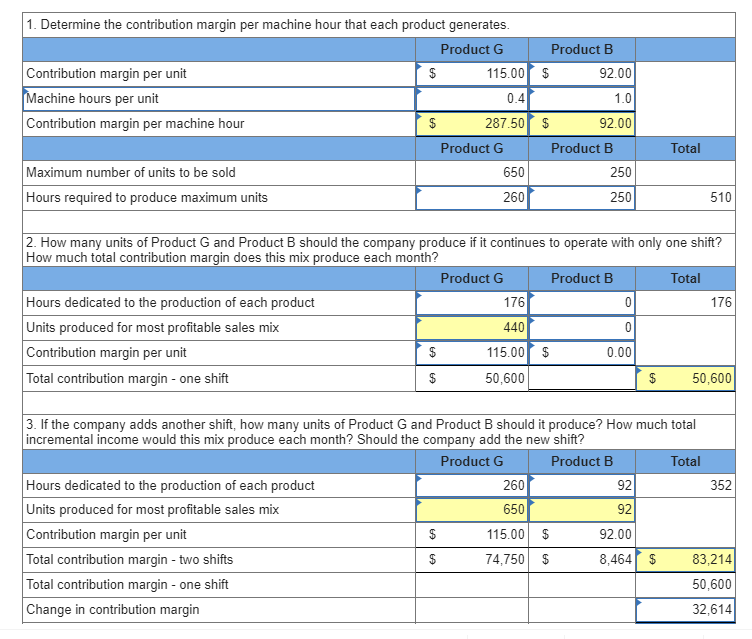

When allocating scarce resources, the contribution margin will help them focus on those products or services with the highest margin, thereby maximizing profits. Fixed costs and variable costs vary for every company as each has its unique business model, product line, operational structure, and production inputs. On your company income statement, you start with revenue and subtract the cost of goods sold to get your gross profit.

How confident are you in your long term financial plan?

By optimising the selection and proportion of products you offer, you can maximise revenue while minimising costs, leading to a healthier bottom line. The companies that operate near peak operating efficiency are far more likely to obtain an economic moat, contributing toward the long-term generation of sustainable profits. Aside from the uses listed above, the contribution margin’s importance also lies in the fact that it is one of the building blocks of break-even analysis.

- Every product that a company manufactures or every service a company provides will have a unique contribution margin per unit.

- The break even point (BEP) is the number of units at which total revenue (selling price per unit) equals total cost (fixed costs + variable cost).

- The higher a product’s contribution margin and contribution margin ratio, the more it adds to its overall profit.

- If they exceed the initial relevant range, the fixed costs would increase to \(\$400\) for nine to sixteen passengers.

Where C is the contribution margin, R is the total revenue, and V represents variable costs. This means that the production of grapple grommets produce enough revenue to cover the fixed costs and still leave Casey with a profit of $45,000 at the end of the year. In our example, a ratio of 36.97% means that every dollar in sales contributes approximately $0.37 (thirty-seven cents) toward fixed costs. This margin helps you assess the profitability and efficiency of your core business. It indicates the amount each product contributes to company profits and helps you to make smart strategic decisions around your pricing, cost control, and product mix.

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Fixed costs are often considered sunk costs that once spent cannot be recovered. These cost components should not be considered while making decisions about cost analysis or profitability measures.

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

It represents the portion of your sales revenue not used by variable costs and therefore contributes to covering your fixed costs. If you need to estimate how much of your business’s revenues will be available to cover the fixed expenses after dealing with the variable costs, this calculator is the perfect tool for you. You can use it to learn how to calculate contribution margin, provided you know the selling price per unit, the variable cost per unit, and the number of units you produce. The calculator will not only calculate the margin itself but will also return the contribution margin ratio. For the month of April, sales from the Blue Jay Model contributed \(\$36,000\) toward fixed costs. Looking at contribution margin in total allows managers to evaluate whether a particular product is profitable and how the sales revenue from that product contributes to the overall profitability of the company.