You can automatically or manually compute the AP turnover ratio for the time period being measured and compare historical trends. The Accounts easily forecast and fund cash flow gaps measures the number of times a company pays its accounts payable during a given period, typically a year. It is an essential financial metric as it reflects the effectiveness of the company’s credit and payment policies. A high Accounts Payable Turnover Ratio indicates that a company has an efficient and timely payment system, which is important in maintaining a good relationship with vendors and suppliers.

Trend Analysis

Instead, investors who note the AP turnover ratio may wish to do additional research to determine the reason for it. For businesses with seasonal sales patterns, such as retail or agriculture, the AP turnover can fluctuate significantly throughout the year. This seasonality must be accounted for to avoid misinterpretation of the ratio at different times of the year.

Ways to Lower AP Turnover Ratio

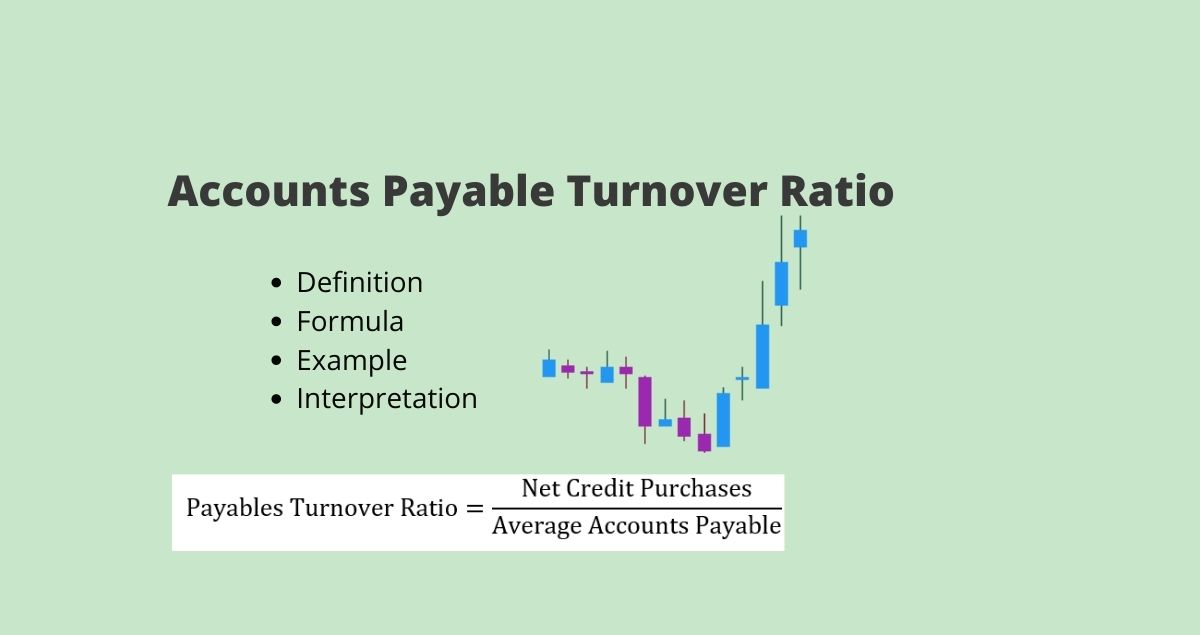

The accounts payable turnover ratio measures how quickly a business makes payments to creditors and suppliers that extend lines of credit. Accounting professionals quantify the ratio by calculating the average number of times the company pays its AP balances during a specified time period. On a company’s balance sheet, the accounts payable turnover ratio is a key indicator of its liquidity and how it is managing cash flow. In simple terms, the AP turnover ratio measures how quickly a company can pay off its suppliers within a certain period, typically a month or a year.

AP Turnover vs. AR Turnover Ratios

- Creditors can use the ratio to measure whether to extend a line of credit to the company.

- That’s why it’s important that creditors and suppliers look beyond this single number and examine all aspects of your business before extending credit.

- Mosaic integrates with your ERP to gather all the data needed to monitor your AP turnover in real time.

Automated systems can provide real-time insights into payable and spending patterns, enabling more strategic decision-making. Improved cash flow management inherently affects the AP turnover ratio by ensuring funds are available for timely payments. Faster invoice processing means that payments can be processed more quickly, directly influencing the AP turnover ratio by potentially increasing it. This speed not only improves efficiency but also enhances supplier relationships through timely payments. Economic conditions, like interest rates or a recession, can impact a company’s payment practices. In a tight credit market, companies might delay payments to maintain liquidity, decreasing the turnover ratio.

Payables Turnover Ratio Formula

That means the company has paid its average accounts payable balance 6.25 times during that time period. As a result of the late payments, your suppliers were hesitant to offer credit terms beyond Net 15. As your cash flow improved, you began to pay your bills on time, causing your AP turnover ratio to increase. Since the accounts payable turnover ratio is used to measure short-term liquidity, in most cases, the higher the ratio, the better the financial condition the company is in. One of the most important ratios that businesses can calculate is the accounts payable turnover ratio.

Streamlining Invoice Processing

Conversely, in a booming economy, companies might pay faster due to better cash flow, increasing the ratio. On the other hand, a low AP turnover ratio can raise concerns about a company’s financial management. It may signal cash flow problems, indicating that the company is not efficiently settling its payables.

A company’s investors and creditors will pay attention to accounts payable turnover because it shows how often the business pays off debt. If the company’s AP turnover is too infrequent, creditors may opt not to extend credit to the business. Whether you aim to increase your turnover ratio to free up cash flow or negotiate extended payment terms to preserve capital, strategic management of accounts payable is key.

AP turnover shows how often a business pays off its accounts within a certain time period. Accounts receivable turnover ratio shows how often a company gets paid by its customers. Remember, the decision to increase or decrease the AP turnover ratio should be based on the specific circumstances and financial goals of the company. It’s essential to strike a balance between maintaining good relationships with suppliers and managing cash flow effectively. Meals and window cleaning were not credit purchases posted to accounts payable, and so they are excluded from the total purchases calculation.

As you can see, Bob’s average accounts payable for the year was $506,500 (beginning plus ending divided by 2). This means that Bob pays his vendors back on average once every six months of twice a year. This is not a high turnover ratio, but it should be compared to others in Bob’s industry. The accounts payable turnover formula is calculated by dividing the total purchases by the average accounts payable for the year. Your accounts payable turnover ratio tells you — and your vendors — how healthy your business is. Comparing this ratio year over year — or comparing a fiscal quarter to the same quarter of the previous year — can tell you whether your business’s financial health is improving or heading for trouble.

This can indicate that the company is managing its debts and cash flow effectively. The accounts payable turnover ratio is a short-term liquidity measure used to quantify the rate at which a company pays off its suppliers. It shows how many times a company pays off its accounts payable during a particular period.